Why the Automotive Printed Electronics Market is Essential for the Future of Mobility?

Maria Yardena . Follow

3 months ago

Key Highlights

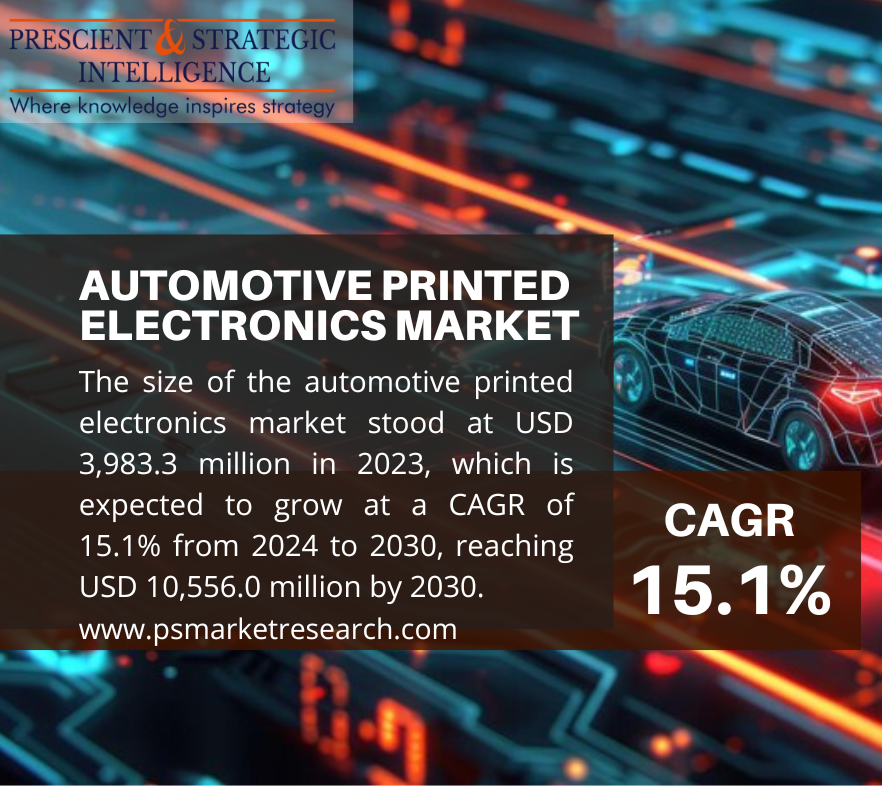

· The automotive printed electronics market was USD 3,983.3 million in 2023, and it will touch USD 10,556.0 million, with a 15.1% CAGR, by 2030.

· Because of the continuing improvements in technology and the increasing incorporation of electrical components in automobiles, the industry is growing remarkably.

· The rising consumer need for eco-friendly products amidst the growing worries for the environment has shaped a substantial shift toward sustainability in the automotive sector.

· The printed electronics sector is also being significantly impacted by this shift, with manufacturers constantly concentrating on manufacturing environmentally-friendly products that can satisfy customer's requirements.

· The conventional approach employed for producing automotive electronics regularly involved resource-intensive materials and methods, which resulted in widespread energy consumption, production waste, and pollution.

· Adopting these advanced printed electronics delivers many ecological advantages that are consistent with the idea of saving resources and circular economy principles.

· The advanced manufacturing methods being employed for making printed electronics require less raw material, and they also ensure less waste.

· Manufacturers can decrease the effect on the environment by employing inkjet printing, screen printing, and spray jet printing, which assists in preventing material waste and improving resource utilization.

· Industry organizations as well as certifications that involve UL Environment and ISO 14001 also established requirements and provided suggestions for eco-friendly practices.

· Above all, the manufacturers are being persuaded to invest in this sustainable technology by the stringent environmental rules and regulations globally.

Market Insights

The inkjet category led the industry in 2023, with approximately 40% share. The players are more concentrated on inkjet printing because it is more scalable, cost-effective, and flexible than other printing technologies. Furthermore, this technique assists in decreasing material waste, thus, allowing the production of highly valuable components at low expenses.

The substrates category was the largest contributor to the industry in 2023, with approximately 70% share, and will remain the largest throughout this decade. This can be because of the outstanding flexibility of the substrates, which makes it possible to develop mechanically bendable circuits at low prices.

Passenger vehicles led the industry in 2023, with approximately 40% share. Because of the rising need for passenger cars, such as hatchbacks and SUVs, the requirement for printed electronics is also rising because of their different functionalities.

The display category accounted for the largest share of the industry. This can be mainly attributed to the rise in the need for HMI systems in automobiles.

APAC led the industry, and it is likely to continue this trend throughout this decade. The leading position of the regional industry is mainly ascribed to the increasing funding in research & development, coupled with the high adoption of printed electronics in automobiles.

Moreover, the region is home to some of the major as well as most efficient automotive and electronics manufacturing hubs across the globe. Due to their enormously vast supply chains, advanced technological and manufacturing skills; and powerful automotive sectors, regional nations are suitable for the manufacturing of printed electronics for vehicles.

The industry is highly competitive, with companies strongly concentrating on finances, market potential, and investments. Players are establishing new strategies and manufacturing hubs to enhance their global presence.

Source: P&S Intelligence